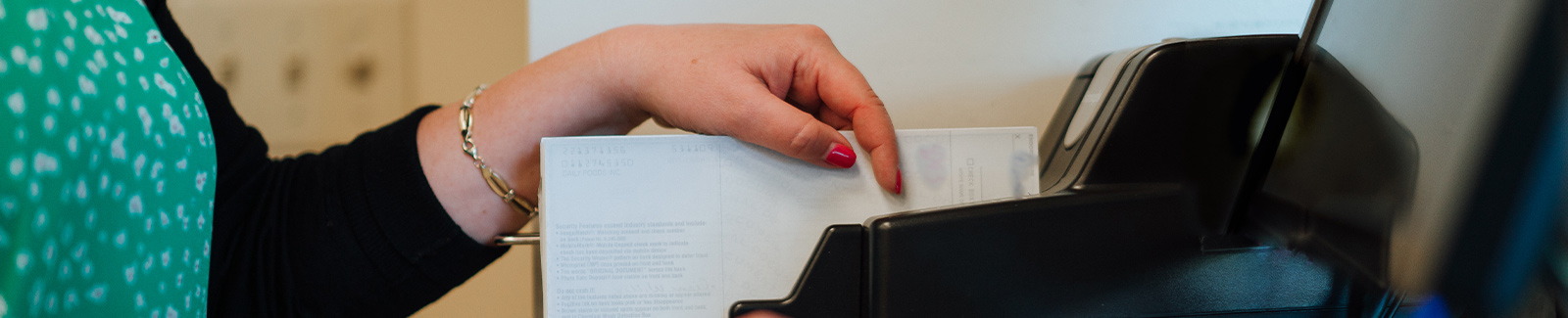

Scan checks from your desk and deposit them automatically — no branch visits necessary.

- Reduce trips to the bank

- Fewer errors in accounting

- Enhanced security and fraud protection

- Consolidate deposits from multiple locations

- Make deposits even when bank is closed1

- Payments are processed faster

- Automated transaction validation and balancing

- Improved research capabilities

- Transaction log includes check images and data

Our eDeposit checking account, linked to your RDC machine, provides the convenience of depositing checks from your business without a trip to the bank. The monthly earnings credit also helps offset maintenance and account fees to help keep costs low.

- Earnings credit is tiered for a greater credit on larger balances2

- Credit will be applied to reduce or eliminate monthly fees, including:

- $50 monthly service fee

- $0.10 per eDeposit made

- $0.50 per deposit made in branch

- $0.15 per deposited item

- $0.20 per check paid

- $0.50 per ACH item

- $0.15 per $100 cash deposited

- No minimum balance requirement

- Free Visa® debit card with valuable eRewards

- Free business digital banking

- Additional business services available

- $100 minimum deposit to open

To sign up for Remote Deposit Capture, or any of our Business/Treasury Management Services, please contact our Business Services Department:

Phone: 315-532-6398

Email: [email protected]

You can also stop by any one of our branch offices during banking hours. A staff member will schedule an appointment with our Cash Management Officer who will meet with your business to review the service and your specific needs.

1 Deposits made after bank hours and on weekends are processed the following business day.

2 Earnings credit will be calculated towards the reduction of service charges on your analyzed account. The earnings credit will be determined by the bank on the first day of each month, to be in effect for that month, and may change on the first day of any month. The earnings credit is set at the discretion of the bank. No index or rate is used to determine the earnings credit. All earnings credits calculated for the month may only be used in the month in which the earnings credit is earned, no carry over is allowed. Your collected balance will be reduced by a 10% reserve requirement prior to the calculation of the earnings credit. Refer to Rate Sheet for the earnings credit rates that apply to your account.